🔥 This offer expires in:

🔥 This offer expires in:

+1 000-000-000

For Middle-Class Families Watching College Costs Skyrocket

How Middle Class Families are Saving Tens of Thousands on College-- Even if They Don't Qualify for Financial Aid.

What if I told you there's a proven system that could save your family up to $50,000+ on college costs? Introducing "Cracking the College Cost Code." This isn't another generic "save for college" guide. This is a research-backed blueprint containing 50+ specific strategies that ordinary families are using to dramatically reduce college costs-some by $100,000 or more.

INTRODUCING CRACKING THE COLLEGE COST CODE

51% of Middle-Income Students Take Federal Loans To Pay for College - Break Free Today.

Are you tired of watching college tuition costs spiral out of control while your family gets caught in the financial crossfire? You know the feeling...

✗ You make "too much" for need-based aid, but not nearly enough to pay $30,000+ per year

✗ You're terrified your child will graduate with crushing debt that haunts them for decades

✗ Every college savings calculator makes you feel like you're already behind

✗ You've heard about scholarships but don't know where to start or how to win them

✗ The financial aid process feels like a maze designed to confuse you.

The colleges don’t warn you. The financial aid office doesn’t tell you the full truth. And the "experts" online? Mostly trying to sell you loan programs or private consulting.

But here's the thing: Some families—families just like yours—are quietly paying $30,000 to $50,000 LESS than their neighbors for the exact same college. How? They understand the system. And they know where to find the cracks.

Avoid a $20,000+ Annual Penalty

College costs increase 3-5% annually, far outpacing inflation and wage growth. Without strategic planning, waiting just one year to implement these strategies could cost your family $20,000+ in additional expenses. This guide reveals how to lock in savings and beat these relentless cost increases before they devastate your budget.

Same Access As Elite Families

Wealthy families don't pay sticker price for college - they use insider strategies, tax loopholes, and funding mechanisms that most middle-class families never hear about. This guide exposes the exact same strategies that allow affluent families to send their kids to top schools for a fraction of the cost, giving you the same advantage.

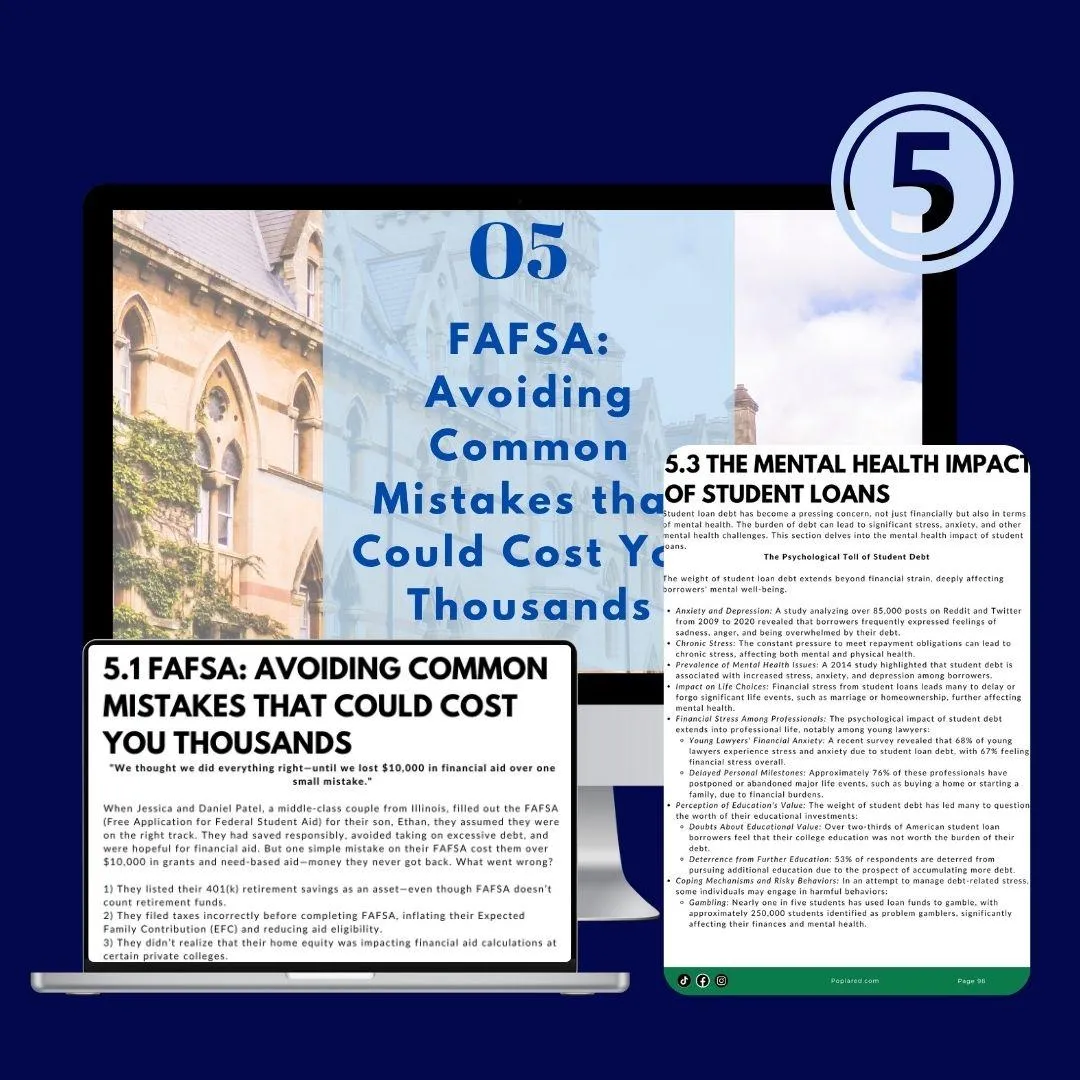

FAFSA Mistakes Cost $24,000+ Per Year

The average family leaves $24,000+ in financial aid on the table annually due to simple FAFSA errors and timing mistakes. Colleges won't tell you this because they profit from your confusion. We'll show you how to optimize your financial aid eligibility and claim every dollar you're entitled to, not just what schools want to give you.

Student Loans Create 20-Year Debt Slavery

The average graduate now carries $37,000+ in student debt with 6-7% interest rates, creating a 20-year payment plan that costs over $60,000 total. This guide shows you how to fund college without becoming a slave to loan servicers who profit from keeping your family trapped in debt for decades.

MORE THAN JUST A PDF

Knowledge is power. Introducing your superpower...

Right after your purchase, you'll receive the link to download our guide jam packed with 50+ strategies over 130+ pages!

Part 1: The College Cost Reality Check

Understand why the sticker price is a trap

Learn what drives the actual cost of college

Discover the possible hidden fees and tuition inflation

Why two families can pay drastically different amounts for the same school

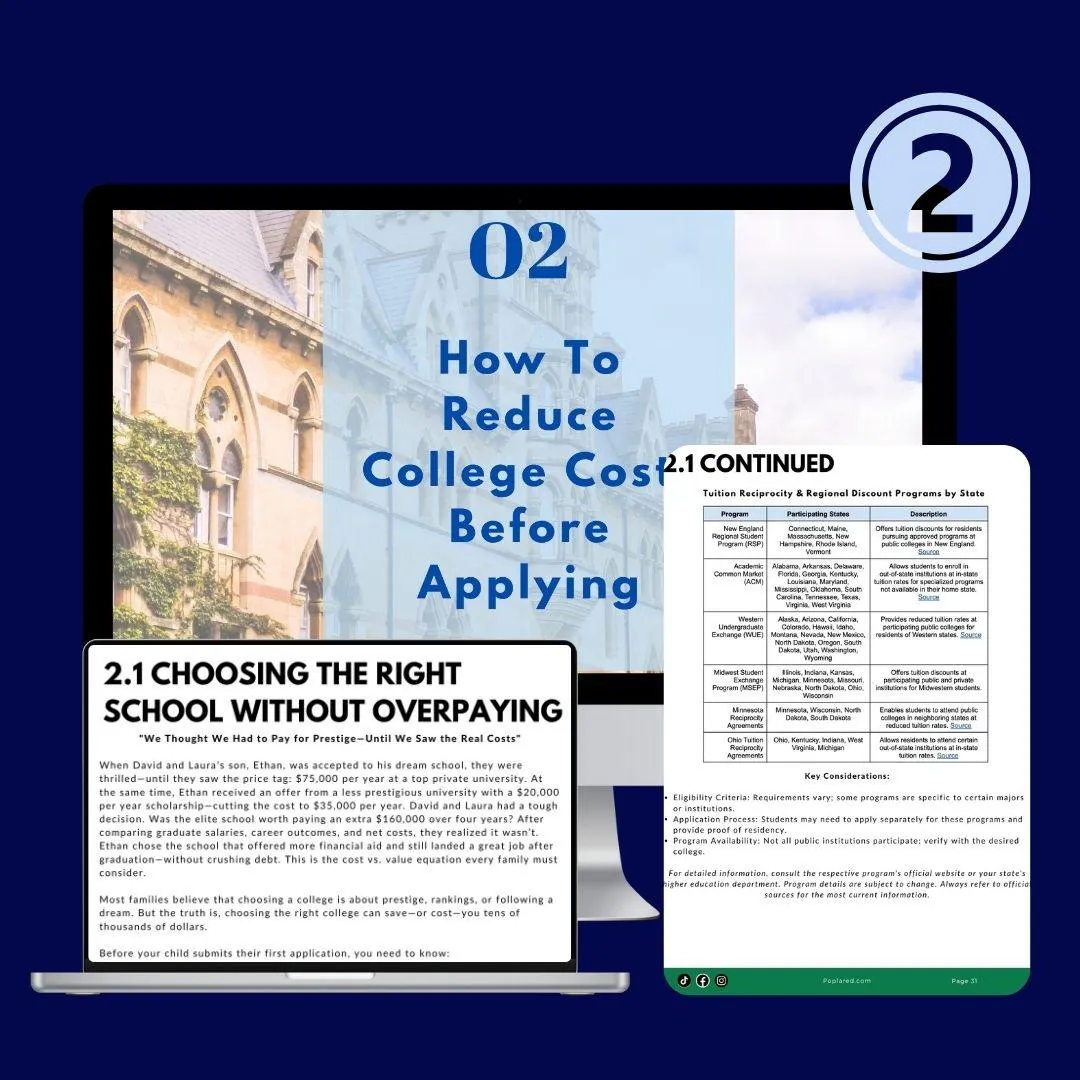

Part 2: Pre-Application Cost-Cutting Strategies

Learn how to restructure your finances

Know the costly financial mistakes families make with their personal finances

Understand how to unlock merit aid before you apply

Unlock the academic, financial, and timing-based tactics to position your family for maximum savings.

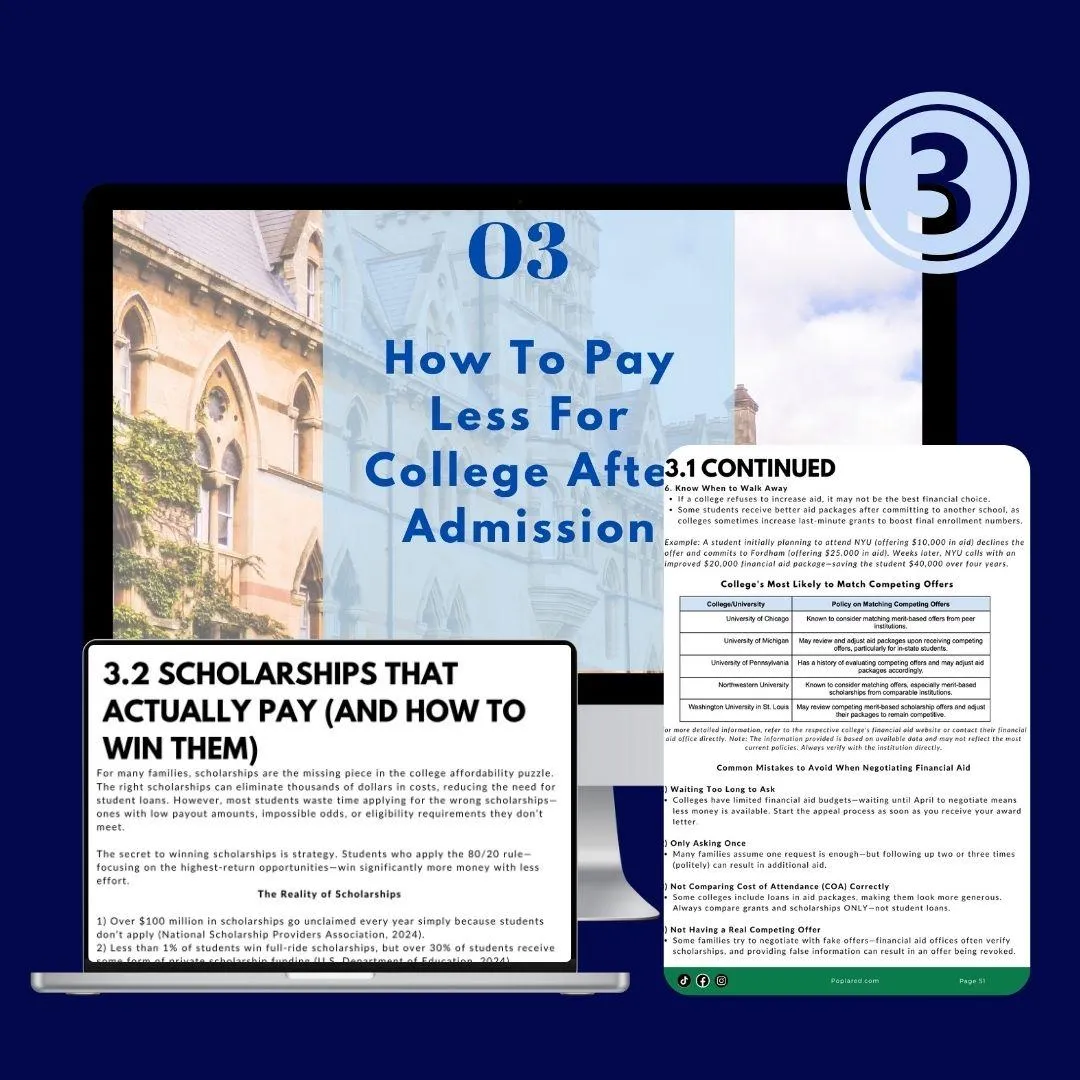

The Financial Freedom Formula...

Learn about negotiating increased merit aid

How to make the most of scholarships with a step-by-step guide

Ways to save on tuition that colleges don't advertise

How work study and part time jobs fit into the equation

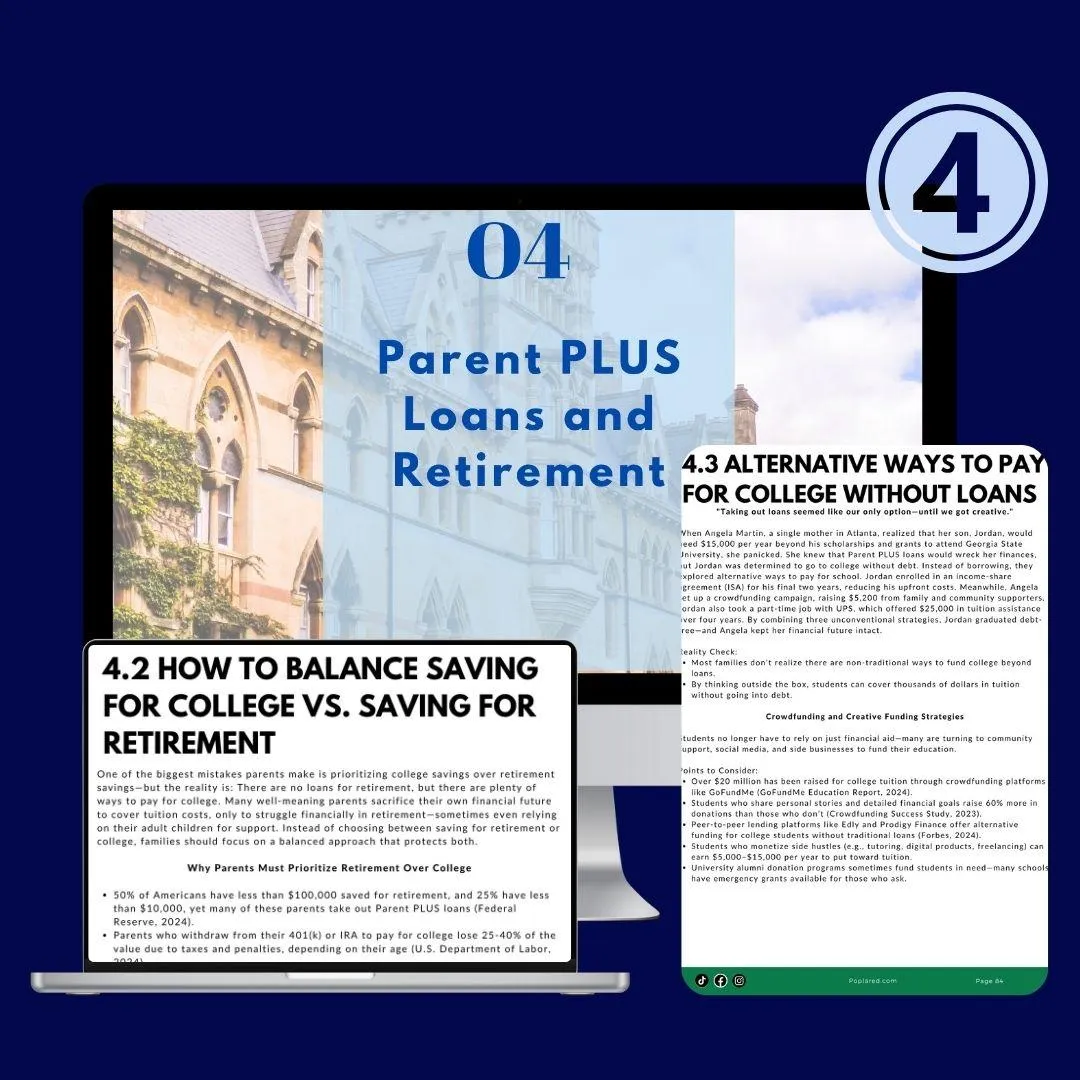

Part 4: Smart, Alternative Ways to Fund College

Learn ways to fund college without debt

Explore unconventional methods most families never consider

Learn about little-known funding sources that can cover thousands in expenses

Most important, learn how to protect your retirement and avoid loans

Part 5: The FAFSA Optimization System

Learn how to avoid the common mistakes that cost families thousands

Understand optimal timing, asset positioning and income management strategies

Discover the specific words and numbers that trigger maximum aid eligibility on your FAFSA application

Part 6: Your Family's Custom Action Plan

Turn the entire book into a clear, customized plan

Find timelines, checklists and specific action items tailored to your families situations

Whether you're starting early with a 7th grader or later with an 11th grader, there is a guide for you

THE INVESTMENT THAT PAYS FOR ITSELF 1,000x OVER. A $197 VALUE FOR JUST $47!

Think about it: If these strategies save you just $2,000 on college costs, you've made back your investment 42 times over. Most families save $20,000-$50,000 or more.

Exclusive Bonuses Just For YOU!

Along with your copy of Cracking the College Cost Code, you’ll unlock a bonus package designed to make saving on college even easier. These extra tools give you more clarity, more leverage—and more ways to keep money in your pocket.

BONUS 1: Sample Financial Aid Appeal Letters

See exactly how to structure your letter for maximum benefit.

BONUS 2: Sample Call Script to Request More Aid

A step-by-step script to help you guide the conversation to get what you want: more money in your pocket.

BONUS 3: A 4 Year College Checklist

Know exactly what to do as your child advances through middle and high school to set your family up for success when college decisions are due.

BONUS 4: College Cost Calculator Worksheet

Calculate the real cost of any school and ensure you've considered the hidden fees, too.BONUS 5: FAFSA Mistakes Checklist

A handy checklist to use while completing the FAFSA so you know you've done everything right.

Bonus 6: State-by-State Guide to Tuition Discount Programs

See exactly what programs each state offers that no one will tell you about upfront, including tuition discount and reciprocity programs for all 50 states.

READY TO GET STARTED?

Get The Cracking the College Cost Code ebook Today!

When you order this ebook, you are getting over 50 battle-tested strategies used by financial aid pros, former admissions officers, and well-advised families, a step-by-step plan to lower your tuition burden before and after your child applies, and the peace of mind knowing you've made confident, informed choices about college costs that protect your family’s financial future.

Cracking the College Cost Code

$47 USD

VAT/Tax Include

Full 130+ Page Cracking the College Cost Code PDF

BONUS 1: Sample Financial Aid Appeal Letters

See exactly how to structure your letter for maximum benefit.

BONUS 2: Sample Call Script to Request More Aid

A step-by-step script to help you guide the conversation to get what you want: more money in your pocket.

BONUS 3: A 4 Year College Checklist

Know exactly what to do as your child advances through middle and high school to set your family up for success when college decisions are due.

BONUS 4: College Cost Calculator Worksheet

Calculate the real cost of any school and ensure you've considered the hidden fees, too.BONUS 5: FAFSA Mistakes Checklist

A handy checklist to use while completing the FAFSA so you know you've done everything right.

Bonus 6: State-by-State Guide to Tuition Discount Programs

See exactly what programs each state offers that no one will tell you about upfront, including tuition discount and reciprocity programs for all 50 states.

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This guide walks you through why traditional college funding approaches may be costing your family tens of thousands of dollars and introduces proven strategies that smart families use to dramatically reduce college costs. You'll learn step-by-step how to make informed college financial decisions, set up strategic funding plans, and protect your family from crushing student debt while still sending your child to their dream school.

Is this guide suitable for beginners?

Absolutely. We have designed this ebook for families whose child is in 7th grade through senior year, whether it's your first child going to college or your fourth. If you're a middle-class family who's scared you won't qualify for need-based aid, a parent who wants to avoid crushing student loan debt, or someone who wants proven strategies that will work without spending thousands on advisors, this guide if for you.

Do I need to have a 529 plan already to benefit from the strategies?

Not at all! Many of the strategies we share are suitable for any budget and any financial situation. In fact, this guide is perfect for you if you have not started a 529 plan yet.

How quickly can I see results?

You can start implementing many of these strategies immediately, regardless of your child's current grade level, with some families seeing results within weeks through FAFSA optimization and financial positioning tactics. The earlier you start, the more money you'll save, but even families starting in senior year have saved thousands using our last-minute strategies. Most families begin seeing measurable cost reductions within the first semester of implementation.

What resources come with the guide?

Along with the main guide, you’ll get phone, email and letter templates/scripts for negotiating aide, a 4-year college checklist to keep you on track, a college cost calculator worksheet so you ensure you know the real cost of college, FAFSA completion checklist and a State-by-State guide to tuition discounts.

How is this different from free advice I can find online?

Great question! This guide brings everything together in one place, with actionable steps and insider strategies that are often scattered across multiple sources. We’ve condensed years of financial wisdom into a single, easy-to-follow guide to save you time and effort.

Is there a guarantee if I’m not satisfied?

Because this is a digital product, we can’t offer refunds. But we’re confident in the value you’ll get. The strategies inside have helped families save thousands—even tens of thousands—on college costs. Many readers report getting more than their money’s worth within days of reading and applying just a few tactics.

What Happens If You Do Nothing?

Your child graduates with $30,000-$100,000+ in debt

You're forced to co-sign loans that put your retirement at risk

Your family's financial future is compromised for decades

You watch other families send their kids to college debt-free while you struggle

The Investment That Pays For Itself 1,000x Over:

Regular Price: $197. Today Only: $47

WARNING: College costs increase every year, and the strategies that work today may not work tomorrow. The longer you wait, the fewer options you'll have. Get instant access now.

Digital download - Access immediately after purchase

P.S. Remember, this isn't about finding more money to pay for college. It's about paying less for college, period. The strategies inside this guide are working right now for families just like yours. The question is: Will you be one of them?

P.P.S. Still on the fence? Consider this: The average college graduate now has over $37,000 in student loan debt. If these strategies help you avoid even half of that, you'll save $18,500+. That's a 393x return on your $47 investment. Can you afford NOT to try this?

All rights reserved POPLAR EDUCATION

Disclaimer:

This guide is provided for educational and informational purposes only and does not constitute financial, legal, tax, or investment advice. The content is based on research and general strategies related to college funding and financial aid, and is intended to share information about college cost reduction techniques. Individual family financial situations, college choices, and eligibility for financial aid vary significantly, and it's important to consult qualified financial advisors, tax professionals, and college financial aid officers before making any decisions regarding college funding or financial aid applications. We do not guarantee specific results or savings amounts, and financial aid rules, scholarship opportunities, and college funding strategies may change over time. The creators and distributors of this guide are not responsible for any losses, missed opportunities, or damages resulting from actions taken based on its contents. Always verify current information with relevant institutions and professionals before implementing any strategies discussed in this guide.